The attorney for the legal arm of a libertarian-leaning Nevada think tank this past week asked the state district court in Carson City to issue a summary judgment that would essentially put the Governor’s Office of Economic Development (GOED) out of business.

The GOED was created as a way to dispense public tax money from a $10 million Catalyst Fund to companies in hopes of creating new jobs and jumpstarting the recession-retarded economy.

The request for summary judgment grows out of a lawsuit filed earlier this year by the Nevada Policy Research Institute’s Center for Justice and Constitutional Litigation (CJCL) on behalf of Michael Little, a Nevada alternative-energy entrepreneur and a taxpayer, because the GOED planned to give $1.2 million to one of his competitors, SolarCity, a company owned by a billionaire that installs solar panels.

Little owns Landfill Alternative, a company that converts recycled landscape trimmings into biomass.

The suit claims the gift to SolarCity violates the Gift Clause of the state Constitution, which prohibits the state donating or loaning money to any company.

In a deposition given in the court case, GOED’s Executive Director Steven Hill admitted that the state giving money directly to a company would violate the Constitution, so instead the money is funneled through the various county governments.

Sounds like the very definition of a money laundering scheme — a third-party is used to obscure the transfer of illicit funds from the source to its destination.

In the recent court filing, Joseph Becker, chief legal officer and director of the CJCL, points out the state has three times asked the voters of Nevada to amend the Constitution to allow handing out public funds to private companies and each time the amendments soundly defeated.

“This scheme … runs afoul of the plain language of the Nevada State Constitution, the will of the people of Nevada as evidenced by three consecutive four-year elections,” writes Becker, “and, if not held unconstitutional, sets a very dangerous precedent whereby the State, when constitutionally prohibited from acting in certain ways, firsts creates a political subdivision and then subcontracts with that political subdivision to act as an intermediary to do the very thing the Nevada Constitution explicitly prohibits. What next?! Hiring private security companies to conduct warrantless searches in instances where the state would otherwise be constitutionally prohibited?!”

Becker asserts that the case presents no genuine issue of material fact and his client is entitled to judgment as a matter of law because the state “is not entitled to build a case on the gossamer threads of whimsy, speculation, and conjecture” — a reference to case law.

The CJCL motion also quotes at length from an opinion by the Nebraska Supreme Court discussing the constitutional and practical ramifications of that state’s almost identical Gift Clause. The opinion concedes that just about any new factory or retail store might be deemed to benefit a community’s progress and prosperity, but under state law public money cannot be appropriated for private purposes and doing so is self-destructive as well.

“It does not matter what such undertakings may be called or how worthwhile they may appear to be at the passing moment,” the court opines. “The financing of private enterprise by means of public funds is entirely foreign to a proper concept of our constitutional system. Experience has shown that such encroachments will lead inevitably to the ultimate destruction of the private enterprise system.”

In fact, Gift Clauses were enacted in many state constitutions precisely because of the experiences of a number of states during the mid-19th century that loaned public money to private firms for the construction of railroads, canals and other infrastructure only to see the companies go broke and leave the taxpayers holding the debt with no assets to show for it.

“It is an illusion — one that seems to have the persistence of original sin — that prosperity can be attained by taking money from taxpayers and handing it to favored businesses. …” the motion for summary judgment concludes. “The idea of government intervention to influence the composition of a country’s output has long been derided by economists for breeding inefficiency, reducing competition, encouraging lobbying and saddling countries with factories producing products nobody wants.”

As Adam Smith wrote in 1776: “It is the highest impertinence and presumption, therefore, in kings and ministers to pretend to watch over the economy of private people … They are themselves always, and without any exception, the greatest spendthrifts in the society.”

The state should not take from some taxpayers and give to others no matter its motives or methods.

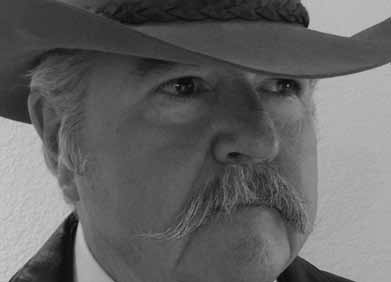

Thomas Mitchell is a longtime Nevada newspaper columnist. You may email him at thomasmnv@yahoo.com. He also blogs at http://4thst8.wordpress.com/.